stochvolTMB is a package for fitting stochastic volatility (SV) models to time series data. It is inspired by the package stochvol, but parameter estimates are obtained through optimization and not MCMC, leading to significant speed up. It is built on Template Model Builder for fast and efficient estimation. The latent volatility is integrated out of the likelihood using the Laplace approximation and automatic differentiation (AD) is used for accurate evaluation of derivatives.

Four distributions for the observational error are implemented:

To install the current stable release from CRAN, use

To install the current development version, use

If you would also like to build and view the vignette locally, use

The main function for estimating parameters is estimate_parameters:

library(stochvolTMB, warn.conflicts = FALSE)

# load s&p500 data from 2005 to 2018

data(spy)

# find the best model using AIC

gaussian <- estimate_parameters(spy$log_return, model = "gaussian", silent = TRUE)

t_dist <- estimate_parameters(spy$log_return, model = "t", silent = TRUE)

skew_gaussian <- estimate_parameters(spy$log_return, model = "skew_gaussian", silent = TRUE)

leverage <- estimate_parameters(spy$log_return, model = "leverage", silent = TRUE)

# the leverage model stands out with an AIC far below the other models

AIC(gaussian, t_dist, skew_gaussian, leverage)

#> df AIC

#> gaussian 3 -23430.57

#> t_dist 4 -23451.69

#> skew_gaussian 4 -23440.87

#> leverage 4 -23608.85

# get parameter estimates with standard error

estimates <- summary(leverage)

head(estimates, 10)

#> parameter estimate std_error z_value p_value type

#> 1: sigma_y 0.008338412 0.0004163314 20.0283029 3.121144e-89 transformed

#> 2: sigma_h 0.273443559 0.0182641070 14.9716359 1.125191e-50 transformed

#> 3: phi 0.967721215 0.0043681868 221.5384240 0.000000e+00 transformed

#> 4: rho -0.748695259 0.0322487815 -23.2162340 3.121690e-119 transformed

#> 5: log_sigma_y -4.786882463 0.0499293427 -95.8731319 0.000000e+00 fixed

#> 6: log_sigma_h -1.296660043 0.0667929683 -19.4131220 5.978190e-84 fixed

#> 7: logit_phi 4.110221202 0.1375467861 29.8823500 3.337032e-196 fixed

#> 8: logit_rho -1.939958912 0.1467670249 -13.2179481 6.912403e-40 fixed

#> 9: h -0.536254072 0.5182192669 -1.0348015 3.007616e-01 random

#> 10: h -0.207811236 0.4245258952 -0.4895137 6.244781e-01 random

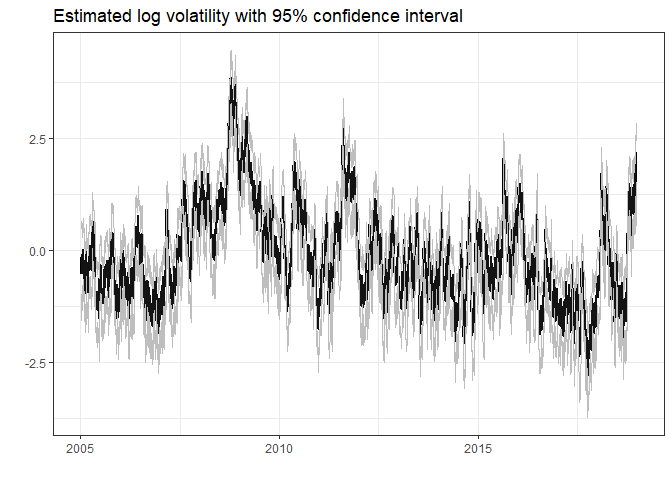

# plot estimated volatility with 95 % confidence interval

plot(leverage, include_ci = TRUE, dates = spy$date)

Given the estimated parameters we can simulate future volatility and log-returns using predict.

set.seed(123)

# simulate future prices with or without parameter uncertainty

pred = predict(leverage, steps = 10)

# Calculate the mean, 2.5% and 97.5% quantiles from the simulations

pred_summary = summary(pred, quantiles = c(0.025, 0.975), predict_mean = TRUE)

print(pred_summary)

#> $y

#> time quantile_0.025 quantile_0.975 mean

#> 1: 1 -0.03787452 0.03639606 -2.352005e-04

#> 2: 2 -0.03750167 0.03718038 7.938422e-05

#> 3: 3 -0.03759011 0.03677040 -6.930858e-05

#> 4: 4 -0.03667977 0.03841486 2.810659e-04

#> 5: 5 -0.03674431 0.03679402 -1.421016e-04

#> 6: 6 -0.03531571 0.03708404 2.750826e-04

#> 7: 7 -0.03706161 0.03531337 -9.648350e-05

#> 8: 8 -0.03654679 0.03581507 -9.638224e-05

#> 9: 9 -0.03558469 0.03600052 -7.431832e-05

#> 10: 10 -0.03551163 0.03483791 -3.915279e-04

#>

#> $h

#> time quantile_0.025 quantile_0.975 mean

#> 1: 1 0.41447216 2.519873 1.455147

#> 2: 2 0.27225022 2.568749 1.408390

#> 3: 3 0.10808006 2.612277 1.363972

#> 4: 4 0.01248118 2.639010 1.322519

#> 5: 5 -0.12153490 2.658716 1.276073

#> 6: 6 -0.20817536 2.688433 1.239662

#> 7: 7 -0.28558724 2.696168 1.199534

#> 8: 8 -0.37711849 2.699062 1.160366

#> 9: 9 -0.46776638 2.718274 1.124317

#> 10: 10 -0.55249774 2.705546 1.086525

#>

#> $h_exp

#> time quantile_0.025 quantile_0.975 mean

#> 1: 1 0.010125271 0.02945742 0.01790539

#> 2: 2 0.009421133 0.03039987 0.01765869

#> 3: 3 0.008772480 0.03099832 0.01736513

#> 4: 4 0.008319762 0.03130376 0.01715038

#> 5: 5 0.007848844 0.03163646 0.01677779

#> 6: 6 0.007459083 0.03191093 0.01657714

#> 7: 7 0.007125009 0.03202311 0.01631264

#> 8: 8 0.006833992 0.03228772 0.01612161

#> 9: 9 0.006592298 0.03264210 0.01588995

#> 10: 10 0.006231481 0.03240400 0.01567428

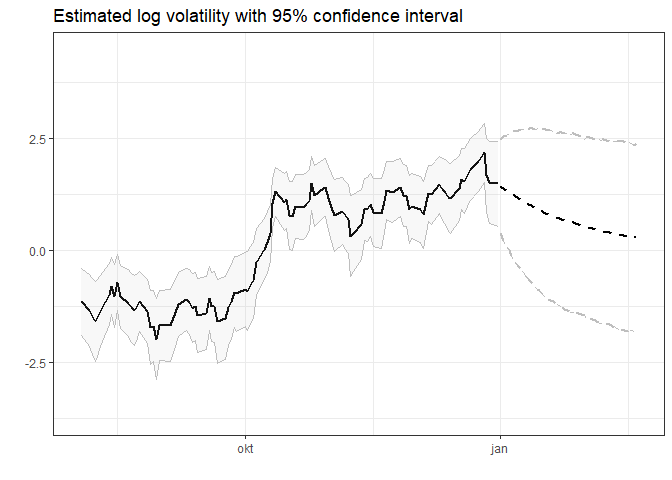

# plot predicted volatility with 0.025 and 0.975 quantiles

plot(leverage, include_ci = TRUE, forecast = 50, dates = spy$d) +

ggplot2::xlim(c(spy[.N, date] - 150, spy[.N, date] + 50))

#> Warning: Removed 3419 row(s) containing missing values (geom_path).

#> Warning: Removed 3419 row(s) containing missing values (geom_path).

#> Warning: Removed 3419 row(s) containing missing values (geom_path).

By running demo() you start a shiny application where you can visually inspect the effect of choosing different models and parameter configurations